Nebraska Personal Property

Who Must File A Nebraska Personal Property Return?

- Anyone who owns or holds any taxable, tangible business personal property on January 1st, 12:01 a.m. of each year.

- Anyone who leases business personal property from another.

- Anyone who leases business personal property to another.

The most common types of personal property in most businesses are 5 and 7 year recovery period property.

Below are some examples of commonly reported property.

Below are some examples of commonly reported property.

Examples of 7 year recovery period property:

Examples of 5 year recovery period property:

- Chairs

- Desks

- Furniture

- Shelving

- Filing Cabinets

- Signage

- Art work

- CRT Televisions

- Computers

- Printers

- Copiers

- Computer Monitors

- LCD/LED TVs

- Mechanic hand tools

- Landscaping hand tools

- Barber/Stylist Equipment

- Restaurant Equipment (i.e. deep fryers, grills, etc.)

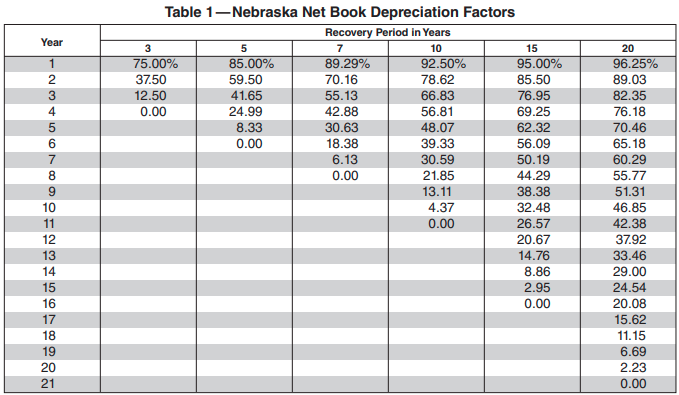

Below is the Nebraska Net Book Depreciation Chart used to calculate the taxable value of business personal property.

Use the following equation to calculate the taxable value: Price paid X the Depreciation % = Taxable Value

Example: $50 X 85% (.85) = $42.50

Contact the County Assessor office if you have any questions or require clarification of your particular equipment.

Due Dates and Penalties

- Business personal property forms must be filed annually with the County Assessor’s Office by May 1st of each year.

- Business personal property returns filed after May 1st but before June 30th will be subject to a statutory ten percent (10%) penalty of the tax due on the taxable value added.

- Business personal property returns filed after July 1st will be subject to a statutory twenty-five percent (25%) penalty.

- If you do not file a personal property return, an estimate assessment will be made on your behalf with a twenty-five percent (25%) penalty added.

- When business personal property becomes taxable because it is no longer owned by a tax exempt entity, the owner or agent has thirty (30) days to report the business personal property; after the thirty (30) days, the assessor shall list and value the business personal property with any applicable penalties.

Did you close or sell your business?

Please notify the Assessor's Office with the following information in writing:

- Name of Business

- County ID or Account Number

- Date of closure

- If you sold your business to a new individual or entity, include the new owner’s information if you have it available.

- Signature

- Contact information

- Please note that if you closed or sold your business after the assessment January 1st you will be responsible for the entire tax year.

Please note that you cannot file returns or applications relating to LB 775, Tax Increment Financing, and

Nebraska Advantage Act Projects on-line. Please file hard copy returns with the County Assessor's Office.